IMPORT BANK GUARANTEES

Bank Guarantees Used For Financing Imports

Bank Guarantees are the perfect method of import financing, providing protection to both importers and exporters in cross-border trade. Bank Guarantees offer an absolute guarantee of performance and payment to the exporter, who then bears no further payment default risk, which positions the importer to negotiate more favorable deal terms.

Bank Guarantees For Imports Overview

Bank Guarantees just may be the perfect method of financing import trade. They offer numerous benefits, protecting both importers and exporters in cross-border trade transactions. Chief among the benefits of using bank guarantees is that they grant an absolute guarantee of performance and payment to the exporter in international trade deals.

With a bank guarantee in a cross-border trade transaction, the exporter no longer bears any payment default risk. With no risk of default and the exporter feeling much more secure with the transaction, an importer is in a much better position to negotiate favorable deal terms.

» Bank Guarantees provide comfort to exporters who get an absolute guarantee of payment

» Importer almost certainly gains the ability to negotiate favorable trade terms

» Bank Guarantees give small businesses immediate acceptance in global trade deals

» They are universally accepted, giving importers the leverage to buy anywhere in the world

» They eliminate payment default risk which gives importers and exporters flexibility in negotiating terms

Bank Guarantees

A letter of credit is an obligation by a bank to make a payment once certain contractual criteria are met. Once the required terms are completed and confirmed, the bank will transfer the funds. The clear purpose is to ensure payment will be made as long as the services are performed.

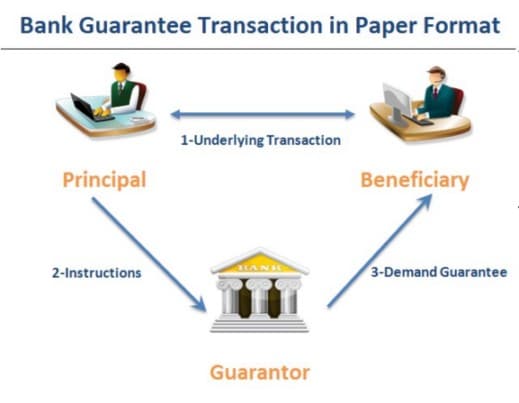

Similarly, a Bank Guarantee is a financial instrument issued by a bank that guarantees that a stipulated sum will be paid to a beneficiary. However, unlike a letter of credit, the sum is only paid if the opposing party in the subject transaction does not fulfill the stipulated obligations under the contract. Thus, a Bank Guarantee essentially serves to ensure a buyer or seller against losses or damage due to nonperformance of the other party to the transaction.

Using Bank Guarantees For Imports

Bank Guarantees might be used when a buyer obtains goods from a seller but is then unable to pay the seller as agreed. The Bank Guarantee would pay the seller in the transaction a contractually agreed upon amount.

Similarly, if a seller was unable to deliver the goods according to the terms of a contract, a BG would obligate the bank to pay the purchaser the contractually agreed-upon amount. Essentially, Bank Guarantees are a safety mechanism for the opposing party in the transaction.

Bank Guarantees are often used in trade financing when buyers and sellers are purchasing and selling goods to and from overseas customers with whom they have no established relationship, in which case a BG is designed to reduce the risk which is borne by each party to a transaction.

Benefits Of Using Bank Guarantees For Imports

Global Trade Funding provides world-class advisory services to assist clients in the deal structuring of every transaction undertaken. This includes Bank Guarantee advisory support to structure and negotiate the terms of Bank Guarantees. See Advisory Services.

- Bank Guarantees give small businesses the ability to reassure the opposing parties to a contract that they have the ability to pay for and finance projects that would otherwise seem beyond their capacity

- Bank Guarantees provide financial credibility and creditworthiness backed by a bank

- Bank Guarantees can be used in virtually every market around the globe and in virtually every business sector

- Bank Guarantees give the parties to a transaction a great deal of flexibility in negotiating contract terms over geography and currency

Trade Finance Learning Center

With more than 80% of the world’s trade depending on trade finance it is an essential segment of the financial services sector. It is also one of the least understood of the financial services. One of the things that undermine people’s understanding of trade finance is the absence of a single vocabulary. Do a search for the definition of import financing, for instance, and the top 20 results will provide 20 different definitions. Our trade finance learning center publishes content that we hope will improve understanding of trade finance and its various component segments. Each of the below tabs provides the factual information you need to make good business decisions, beginning with important trade finance definitions.

Accounts Receivable

Accounts Receivable is money owed to a company by a customer for products and /or services sold. Accounts receivable is considered a current asset on a balance sheet once an invoice has been sent to the customer.

Accounts Receivable Factoring

Accounts Receivable Factoring is a method of Trade Financing where a company sells their accounts receivable in exchange for working capital. The purchaser of the receivables relies on the creditworthiness of the customers who owe the invoices, not the subject company.

For details go to Accounts Receivable Factoring »

Advance Against Documents

Advances Against Documents are loans made solely based on the security of the documents covering the shipment.

Asset Based Lending

Asset Based Lending is a method of Trade Financing that allows a business to leverage company assets as collateral for a loan. Asset-based loans are an alternative to more traditional lending which is generally characterized as a higher risk which requires higher interest rates.

Cash Against Documents

Cash Against Documents is the payment for goods in which a commission house or other intermediary transfers title documents to the buyer upon payment in cash.

Cash in Advance

Payment for goods in which the price is paid in full before shipment is made. This method is usually used only for small purchases or when the goods are built to order.

Cash with Order

Cash with Order is the payment for goods whereby the buyer pays when ordering and in which the transaction is binding on both parties.

Commercial Finance

Commercial Finance is defined as the offering of loans to businesses by a bank or other lender. Commercial loans are either secured by business assets, accounts receivable, etc., or unsecured, in which case the lender relies on the borrower’s cash flow to repay the loan.

Confirmed Letter of Credit

A Confirmed Letter of Credit is a Letter of Credit issued by a foreign bank, which has been confirmed as valid by a domestic bank. An exporter whose form of payment is a Confirmed Letter of Credit is assured of payment by the domestic bank who confirmed the Letter of Credit even if the foreign buyer or the foreign bank defaults.

Consignment

Consignment is a delivery of merchandise from an exporter (the consignor) to an agent (the consignee) subject to an agreement by the agent that the agent will sell the merchandise for the benefit of the exporter, subject to certain limitations, like a minimum price. The exporter (consignor) retains ownership of and title to the goods until the agent (consignee) has sold them. Upon the sale of the goods, the agent typically retains a commission and remits the remaining net proceeds to the exporter.

For details go to Consignment Purchase »

Cross-Border Sale

A Cross-Border Sale refers to any sale that is made between a firm in one country and a firm located in a different country.

Factoring

Factoring is the selling of a company’s invoices and accounts receivable at a discount. The lender assumes the credit risk of the debtor and receives the cash when the debtor settles the account.

For details go to Accounts Receivable Factoring »

Invoice Discounting

Invoice Discounting is a type of loan that is drawn against a company’s outstanding invoices but does not require that the company give up administrative control of those invoices.

factoring invoices

factoring invoices is one of the most common methods of trade financing. Your company sells their invoices to a factor in exchange for immediate liquidity. The factor who purchases the invoices relies on the creditworthiness of the customers who owe the invoices, not the subject company.

For details go to factoring invoices »

Irrevocable Letter of Credit

Irrevocable Letter of Credit is a Letter of Credit in which the specified payment is guaranteed by the bank if all terms and conditions are met by the drawee.

Letter of Credit

Letter of Credit or LC is the most common trade finance solution in the world. A Letter of Credit is a document issued by a bank for the benefit of a seller or exporter, which authorizes the seller to draw a specified amount of money, under specified terms, usually the receipt by the issuing bank of certain documents within a given time.

For details go to Letters of Credit For Imports »

Open Account

Open Account is a trade arrangement in which goods are shipped to a foreign buyer without guarantee of payment. The obvious risk this method poses to the supplier makes it essential that the buyer’s integrity be unquestionable.

For details go to Open Accounts »

Pro forma Invoice

Pro forma Invoice is an invoice provided by a supplier prior to the shipment of merchandise, which informs the buyer of the kinds, nature and quantities of goods to be shipped along with their value, and other important specifications such as weight and size.

Receivable Management

Receivable Management involves processing activities related to managing a company’s accounts receivable including collections, credit policies and minimizing any risk that threatens a firm from collecting receivables.

Revocable Letter of Credit

Revocable Letter of Credit is a Letter of Credit that can be canceled or altered by a buyer after it has been issued by the buyer’s bank.

Structured Trade Finance

Structured Trade Finance is cross-border trade finance in emerging markets where the intention is that the loan gets repaid by the liquidation of a flow of commodities.

Trade Credit Insurance

Trade Credit Insurance is a risk management product offered to business entities wishing to protect their balance sheet assets from loss due to credit risks such as protracted default, insolvency, and bankruptcy. Trade Credit Insurance often includes a component of political risk insurance, which ensures the risk of non-payment by foreign buyers due to currency issues, political unrest, expropriation, etc.

Global Report On Business Regulations 2017

Annual Report On Business Regulations Business Regulations that enhance business activity and those that constrain it are examined in World Bank Annual Report On Business Regulations, entitled Doing Business 2017. It is the 14th

IMF Raised 2017 Global Economic Growth Forecast

Global Economic Growth On The Rise Global economic growth is strengthening according to economists at the International Monetary Fund. The IMF sees positive trends in investment, manufacturing, and trade worldwide. As a result, International

World Trade Week Ordered By Trump To Promote Global Trade

World Trade Week Strengthens Economic Growth President Donald Trump has issued a presidential proclamation to create World Trade Week. World Trade Week will take place the week of May 21 through May 27 per

Dublin · Hong Kong · London · Mexico City · Prague · Sydney · Vancouver · Washington DC · Zurich