Political Risk In Developing Countries

Assessing Trade Finance And Project Finance Risks And Opportunities

Overview of Political Risk In Developing Countries

Political risk in developing countries is real and, at times, severe. In order to assess the effect political risk in developing countries has on project finance and trade finance, we must first define the scope of political risk. When looking at political risk in developing countries historically, it was the risk of expropriation that kept investors and lenders up at night. The prevailing risk was that the host government would seize assets, in the case of investors or collateral in the case of lenders.

But, according to a 2010 study by the Harvard Business Review that is no longer the case. That was hardly the end of political risk in developing countries. The Harvard Study indicates that the risk is still present and is just as dangerous for investors and lenders, it has just evolved becoming largely hidden and much sneakier. “Overt seizures of foreign assets by host countries in emerging markets essentially evaporated by 1980. However, other political risks to those assets, such as potential regulatory action, have risen dramatically since then.”

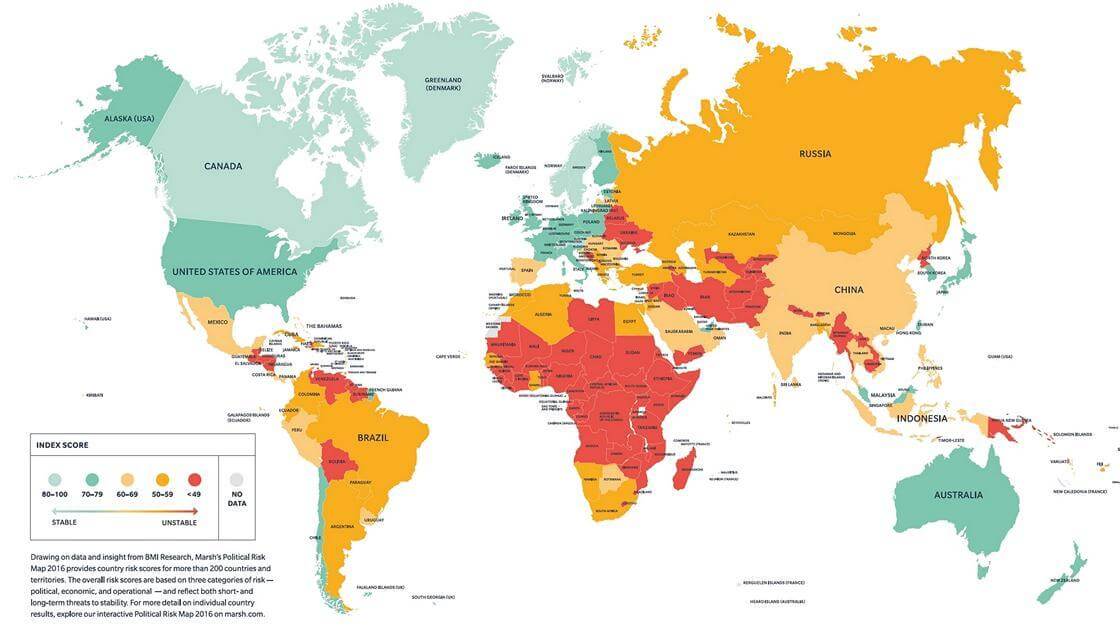

2016 Map of Political Risk In Developing Countries

Defining Political Risk In Developing Countries

Political Risk in developing countries is characterized as the non-market challenges and complications businesses face when investing in developing countries. Although the risks exist continuously in those nations, they are essentially dormant. They become active upon the occurrence of a triggering event. Triggering events can be political decisions that advance new policies which are inconsistent with existing policies or events that are in any way connected to political instability such as terrorism, riot, coup, civil war, insurrection or sedition.

When political risks shift from dormant to active they immediately become both more severe and more likely to occur have the potential of negatively impacting the outcome, profitability or even the viability of investments and business ventures.

Quantifying Political Risk In Developing Countries No Easy Task

Although it is widely believed that geopolitical risk can be quantified and managed, companies that invest in developing countries do so because they generally believe they have adequately quantified the risk they will face to an extent which is sufficient for them to abdicate much of their ability to manage that risk.

For example, a company that is going to build a new facility must decide between two parcels of land for the location of the facility. One of the parcels is significantly less expensive than the other but it is located within the 100-year flood plain, which means it is susceptible to flooding every 100 years. The other parcel is not susceptible to flooding but is considerably more expensive. Because it is sufficiently less expensive, the company may decide to proceed with building on the flood-prone parcel because they believe they have adequately quantified the risk of flooding, even though in so doing they are abdicating their ability to manage future flooding.

Mitigating Political Risk In Developing Countries

Similarly, the risk that political decisions, political conditions or political instability could materially affect the profitability, continuation or even the viability of their business is routinely faced by companies that invest in developing countries. All of these risks also materially affect the risk calculus of project financings that we extend to clients. Until recently, companies interested in investing in developing countries, emerging and frontier markets were limited to a binary choice. They could do the deal and accept the risk exposure in developing countries or pass on the deal and completely avoid the risk.

Neither, in this case, is a good option. Deciding on the first option may force the company to accept more risk than they are comfortable accepting, and the second option, while risk-free, absolutely guarantees they will make zero profits.

What Constitutes A Developing Country

There is no absolute definition or accepted list of characteristics from which to define developing countries. The United Nations, the World Bank and the International Monetary Fund all use flexible definitions because of complaints accusing them of insulting the developing countries.

- people have shorter life expectancies,

- people have less education,

- people have a lower literacy rate,

- people have less money,

- people have less income, and

- women have higher fertility rates.

What Are The Developed Countries?

Although there is no official, accepted list of developed countries, in practice the only truly developed countries are:

- Japan in Asia,

- Canada in North America,

- United States in North America,

- Australia in Oceania,

- New Zealand in Oceania,

- South Africa in Africa,

- Israel in the Middle East, and

- Western Europe in its entirety.

Dublin · Hong Kong · London · Mexico City · Prague · Sydney · Vancouver · Washington DC · Zurich