Trade Finance Compliance Services

Performance In Today’s Shifting Financial Compliance Environment

Trade Finance Compliance Overview

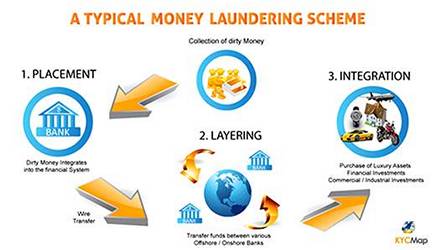

Trade Finance Compliance from institutions is required by international law, along with Anti-Money Laundering AML Compliance and Know Your Customer KYC Compliance. Our core discipline keeps our clients and our firm above reproach.

Anti-Money Laundering AML Compliance and Know Your Customer KYC Compliance is required by numerous global jurisdictions and regulatory agencies. Required AML Compliance and KYC Compliance are very technical and very specific and must comply with US Anti-Money Laundering, Counter-Terrorism Financing laws and the US Patriot Act.

The last two decades have seen a significant rise in the push for globalism and open markets which have resulted in an explosion of foreign trade activity. The last twenty years have also seen an astronomical rise in global terrorism. Both of these trends represent structural changes in economics and governance.

Although these trends are diametrically different, one positive with the explosion of global trade, and the other negative with just an explosion, it is not surprising that the government reacts to both in very much the same way, increased regulation.

Regardless of whether it is skyrocketing world trade or terrorism, it is the inherent nature of government to want more restrictions, more regulations, more compliance paperwork and more fees. In this case, it is more than just the government’s natural tendency towards regulation at work because global terrorism has taught prudent people to be more diligent.

Thus we must acknowledge that expanding global trade opens the door for an increased incidence of cross-border terrorist incidents. This further fuels the government’s instinctual avidity to regulate. It’s a perfect storm of regulatory desire.

Increasing AML Compliance And KYC Compliance Requirements

Because of these factors, there is 100% certainty of increased compliance, Trade Finance Compliance, and paperwork for those who do business importing, exporting, trading or financing trade. Trade Finance Compliance and due diligence are no longer requests, they have become legal responsibilities.

In the US, recent amendments to the Anti-Money Laundering and Counter-Terrorism Financing Acts along with the advent of the Patriot Act provide crystal clear indications of more government requirements to come.

In addition to terrorism, which continues its efforts to reach our shores, money laundering and drug trafficking also pose very real threats to the United States. If you’re involved in international trade or international trade finance, you will have to accept a disproportionate share of the effort to combat these evils.

Expect the demand for increased Trade Finance Compliance and due diligence to grow further. Additional compliance requirements will disproportionately impact small businesses involved in global trade. Large companies and large banks will accept new compliance requirements and new regulations in stride. Performing additional compliance will have no effect on Citibank or Wal-Mart.

After more than 40 years of trying to stop money laundering, the US government has given up and shifted the burden to the private financial sector

Our Trade Finance Compliance Services

As part of any trade finance transaction, compliance on counter-parties is an essential element of the transaction and forms the basis of any new relationship. We understand the importance of vetting fraudulent or unworthy applicants and ensuring that they do not find their way into being involved in the day to day operations of the business.

Many of our clients, especially those from small to medium enterprises (SME) simply aren’t prepared or equipped to follow new Trade Finance Compliance requirements. Part of our Client Advisory service is to perform these procedures for all transactions in which we are involved as a matter of due course so as to minimize the burden on our clients.

Specifically, our Trade Finance Compliance service performs all of the compliance required by the Patriot Act, all of the compliance required by the Anti-Money Laundering & Counter Terrorism Financing Acts, and all of the compliance required by Know Your Client (KYC) regulations. We perform this compliance for all transactions in which we are involved as a matter of due course.

Key Elements of Trade Finance Compliance

Trade Finance Compliance is complex and time-consuming. Many in the industry undertake what they believe to be compliance by typing names and phrases into search engines. Because this produces unverified results that can be manipulated, and is just as likely to produce fake news as anything else, it does not meet Trade Finance Compliance requirements. Real Trade Finance Compliance incorporates these key elements to comply with anti-fraud and anti-money laundering regulations currently in force.

- To establish compliance with Anti-Money Laundering regulations.

- To establish the real identities of individuals involved in the transaction.

- Ascertain that the individuals possess the right qualities to carry out the duties expected of them.

- To check international fraud registers and criminal record bureaus.

- To establish the Ultimate Beneficial Owners (UBO) of the company or companies.

- To ascertain companies are correctly incorporated and their incorporation is current and not hindered by any legal action or pending actions.

- To ascertain that the people and the business involved have the financial capability to deliver what is required of them.

- To obtain a full understanding of the source and history of their investment funds.

Trade Finance Compliance Key Takeaways

As part of any financial transaction, Trade Finance Compliance on counter-parties is an essential element of the transaction and forms the basis of any new relationship. We understand the importance of vetting applicants. Part of our Client Advisory service is to perform these procedures for all transactions in which we are involved as a matter of due course so as to minimize the burden on our clients.

Our Trade Finance Compliance service performs all compliance required by the Patriot Act, the Anti-Money Laundering, and Counter-Terrorism Financing Acts, and Know Your Client (KYC) regulations.

Dublin · Hong Kong · London · Mexico City · Prague · Sydney · Vancouver · Washington DC · Zurich