Import Letters of Credit

Letters of Credit Used For Financing Imports

Import Letters of Credit are the most common import financing methods, offering protection to importers and exporters in cross-border transactions. They offer numerous benefits, primarily a guarantee of payment to the exporter, who then no longer bears payment default risk, which positions importers to negotiate favorable deal terms.

Import Letters of Credit Overview

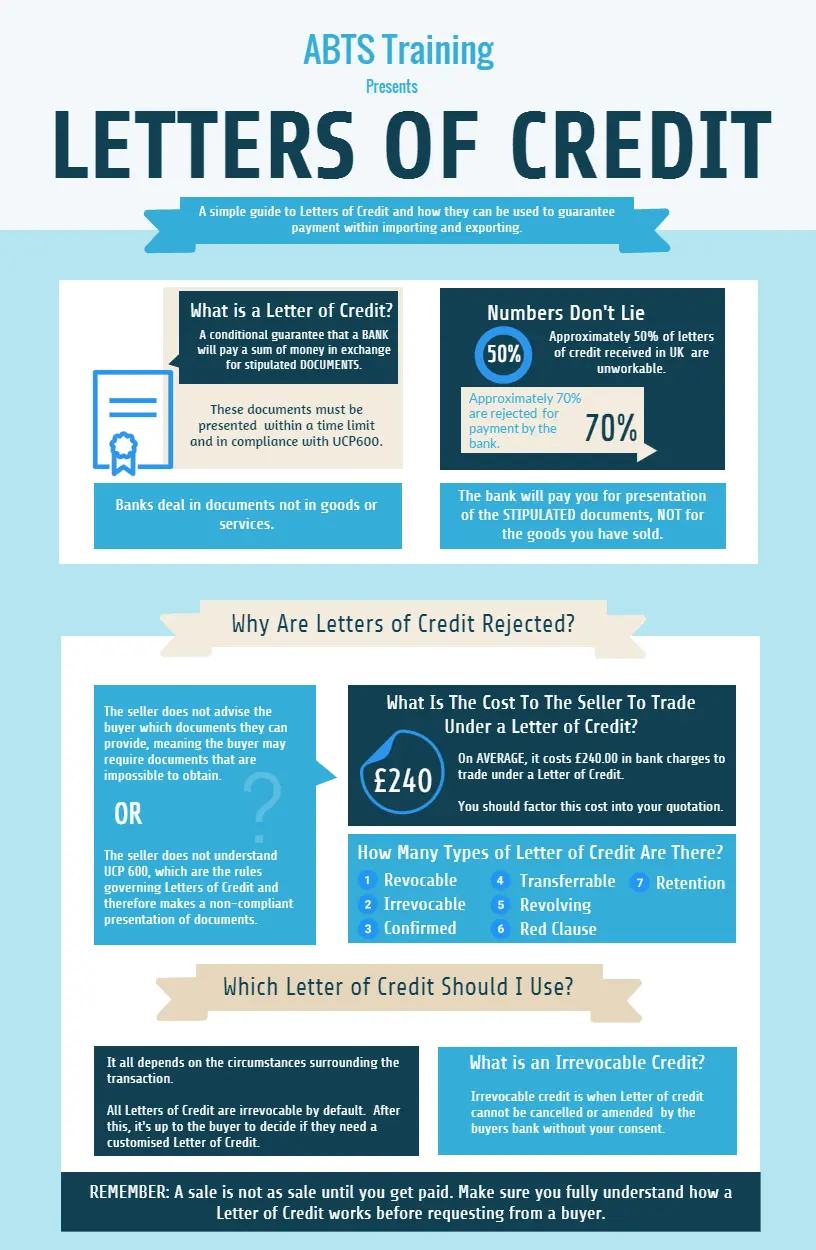

Import Letters of Credit are the most common method of import financing. They are versatile, secure and can be used to finance any import transaction. An Import Letter of Credit is a financial instrument issued by a bank that represents the commitment of the bank, on behalf of an importer that guarantees payment will be made to the exporter provided the terms and conditions specified in the Letter of Credit have been met. Conditions specified in Import Letters of Credit are typically evidenced by the presentation of documents. Since they are credit instruments, issuing banks rely on the credit-worthiness of importers when issuing Import Letters of Credit.

The importer pays the issuing bank a fee to render this service. Import Letters of Credit are useful when there is insufficient credit information about a foreign buyer or the foreign buyer’s credit is unacceptable to the exporter, but the exporter is comfortable with the creditworthiness of the issuing financial institution. Import Letters of Credit are the most common method of trade finance because they also provide protection for the importer since the documents required to trigger payment provide evidence that the goods being purchased have been shipped as agreed.

Letters of Credit In Trade Finance

Introduction to Letters of Credit and Letter of Credit Transactions

Benefits of Letters of Credit Courtesy of ANZ Bank

Import Letters of Credit Key Features

- An Import Letter of Credit, which is also referred to as a documentary credit, is a financial instrument where the issuing bank, acting on behalf of the importer, contractually agrees to pay the beneficiary or exporter the amount stipulated, provided conditions specified in the Letter of Credit have been satisfied.

- The bank that issues an Import Letter of Credit will typically use intermediary banks to facilitate the transaction and make payment to the exporter.

- The Letter of Credit is a separate contract from the contract for the transaction on which it is based. Thus the banks who are involved in financing the transaction are not concerned with the quality of the underlying merchandise or even whether either party fulfills the terms of the sales contract.

- The issuing bank’s obligation to pay pursuant to Import Letters of Credit are solely conditioned upon the seller’s compliance with the terms and conditions specified in the Import Letter of Credit.

- In transactions involving Import Letters of Credit, banks are only concerned with documents, not goods.

Letters of Credit are effective payment instruments that facilitate international trade by providing sellers with an assurance of payment and buyers with cross-border documentary protection.

Using Import Letters of Credit

- Letters of credit are a highly recommended method of funding international trade, and are especially beneficial for high-risk situations, for transactions with new or less-established trade relationships and for transactions where the exporter is satisfied with the creditworthiness of the issuing bank.

- When Letters of Credit are used to finance trade, the transaction risk is fairly balanced between exporter and importer, assuming that all terms and conditions specified in the Letter of Credit are performed.

- Payment in Letter of Credit transactions is only made after the goods are shipped by the exporter. A variety of payment, financing and risk mitigation options are available to both the importer and exporter with Letters of Credit.

- Letters of Credit are a tremendously popular and effective method of financing international trade. They are, however, labor intensive and are a relatively expensive method of financing international transactions.

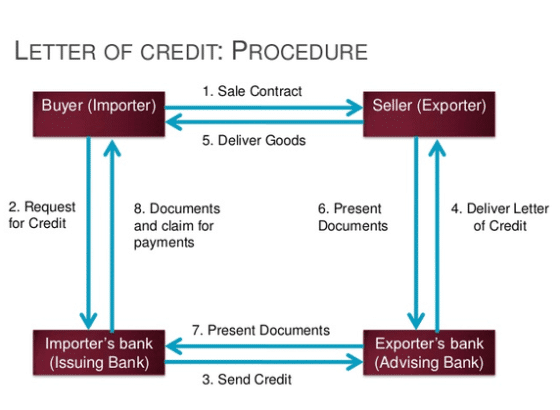

Import Letters of Credit Process

- The importer arranges for the issuing bank to open a Letter of Credit in favor of the exporter.

- The issuing bank transmits the Letter of Credit to the nominated bank, which forwards it to the exporter.

- The exporter forwards the goods and documents to a freight forwarder.

- The freight forwarder dispatches the goods and either the dispatcher or the exporter submits documents to the nominated bank.

- The nominated bank checks documents for compliance with the Letter of Credit and collects payment from the issuing bank for the exporter.

- The importer’s account at the issuing bank is debited.

- The issuing bank releases documents to the importer to claim the goods from the carrier and to clear them at customs.

Trade Finance Learning Center

With more than 80% of the world’s trade depending on trade finance it is an essential segment of the financial services sector. It is also one of the least understood of the financial services. One of the things that undermine people’s understanding of trade finance is the absence of a single vocabulary. Do a search for the definition of import financing, for instance, and the top 20 results will provide 20 different definitions. Our trade finance learning center publishes content that we hope will improve understanding of trade finance and its various component segments. Each of the below tabs provides the factual information you need to make good business decisions, beginning with important trade finance definitions.

Accounts Receivable

Accounts Receivable is money owed to a company by a customer for products and /or services sold. Accounts receivable is considered a current asset on a balance sheet once an invoice has been sent to the customer.

Accounts Receivable Factoring

Accounts Receivable Factoring is a method of Trade Financing where a company sells their accounts receivable in exchange for working capital. The purchaser of the receivables relies on the creditworthiness of the customers who owe the invoices, not the subject company.

For details go to Accounts Receivable Factoring »

Advance Against Documents

Advances Against Documents are loans made solely based on the security of the documents covering the shipment.

Asset Based Lending

Asset Based Lending is a method of Trade Financing that allows a business to leverage company assets as collateral for a loan. Asset-based loans are an alternative to more traditional lending which is generally characterized as a higher risk which requires higher interest rates.

Cash Against Documents

Cash Against Documents is the payment for goods in which a commission house or other intermediary transfers title documents to the buyer upon payment in cash.

Cash in Advance

Payment for goods in which the price is paid in full before shipment is made. This method is usually used only for small purchases or when the goods are built to order.

Cash with Order

Cash with Order is the payment for goods whereby the buyer pays when ordering and in which the transaction is binding on both parties.

Commercial Finance

Commercial Finance is defined as the offering of loans to businesses by a bank or other lender. Commercial loans are either secured by business assets, accounts receivable, etc., or unsecured, in which case the lender relies on the borrower’s cash flow to repay the loan.

Confirmed Letter of Credit

A Confirmed Letter of Credit is a Letter of Credit issued by a foreign bank, which has been confirmed as valid by a domestic bank. An exporter whose form of payment is a Confirmed Letter of Credit is assured of payment by the domestic bank who confirmed the Letter of Credit even if the foreign buyer or the foreign bank defaults.

Consignment

Consignment is a delivery of merchandise from an exporter (the consignor) to an agent (the consignee) subject to an agreement by the agent that the agent will sell the merchandise for the benefit of the exporter, subject to certain limitations, like a minimum price. The exporter (consignor) retains ownership of and title to the goods until the agent (consignee) has sold them. Upon the sale of the goods, the agent typically retains a commission and remits the remaining net proceeds to the exporter.

For details go to Consignment Purchase »

Cross-Border Sale

A Cross-Border Sale refers to any sale that is made between a firm in one country and a firm located in a different country.

Factoring

Factoring is the selling of a company’s invoices and accounts receivable at a discount. The lender assumes the credit risk of the debtor and receives the cash when the debtor settles the account.

For details go to Accounts Receivable Factoring »

Invoice Discounting

Invoice Discounting is a type of loan that is drawn against a company’s outstanding invoices but does not require that the company give up administrative control of those invoices.

factoring invoices

factoring invoices is one of the most common methods of trade financing. Your company sells their invoices to a factor in exchange for immediate liquidity. The factor who purchases the invoices relies on the creditworthiness of the customers who owe the invoices, not the subject company.

For details go to factoring invoices »

Irrevocable Letter of Credit

Irrevocable Letter of Credit is a Letter of Credit in which the specified payment is guaranteed by the bank if all terms and conditions are met by the drawee.

Letter of Credit

Letter of Credit or LC is the most common trade finance solution in the world. A Letter of Credit is a document issued by a bank for the benefit of a seller or exporter, which authorizes the seller to draw a specified amount of money, under specified terms, usually the receipt by the issuing bank of certain documents within a given time.

For details go to Letters of Credit For Imports »

Open Account

Open Account is a trade arrangement in which goods are shipped to a foreign buyer without guarantee of payment. The obvious risk this method poses to the supplier makes it essential that the buyer’s integrity be unquestionable.

For details go to Open Accounts »

Pro forma Invoice

Pro forma Invoice is an invoice provided by a supplier prior to the shipment of merchandise, which informs the buyer of the kinds, nature and quantities of goods to be shipped along with their value, and other important specifications such as weight and size.

Receivable Management

Receivable Management involves processing activities related to managing a company’s accounts receivable including collections, credit policies and minimizing any risk that threatens a firm from collecting receivables.

Revocable Letter of Credit

Revocable Letter of Credit is a Letter of Credit that can be canceled or altered by a buyer after it has been issued by the buyer’s bank.

Structured Trade Finance

Structured Trade Finance is cross-border trade finance in emerging markets where the intention is that the loan gets repaid by the liquidation of a flow of commodities.

Trade Credit Insurance

Trade Credit Insurance is a risk management product offered to business entities wishing to protect their balance sheet assets from loss due to credit risks such as protracted default, insolvency, and bankruptcy. Trade Credit Insurance often includes a component of political risk insurance, which ensures the risk of non-payment by foreign buyers due to currency issues, political unrest, expropriation, etc.

Global Report On Business Regulations 2017

Annual Report On Business Regulations Business Regulations that enhance business activity and those that constrain it are examined in World Bank Annual Report On Business Regulations, entitled Doing Business 2017. It is the 14th

IMF Raised 2017 Global Economic Growth Forecast

Global Economic Growth On The Rise Global economic growth is strengthening according to economists at the International Monetary Fund. The IMF sees positive trends in investment, manufacturing, and trade worldwide. As a result, International

World Trade Week Ordered By Trump To Promote Global Trade

World Trade Week Strengthens Economic Growth President Donald Trump has issued a presidential proclamation to create World Trade Week. World Trade Week will take place the week of May 21 through May 27 per

Dublin · Hong Kong · London · Mexico City · Prague · Sydney · Vancouver · Washington DC · Zurich